In my search to find the reasons for a company to make it to the list of most innovative companies, I looked at various sources. To compare the results, I downloaded the list of most profitable companies along with the basis used for ranking them.

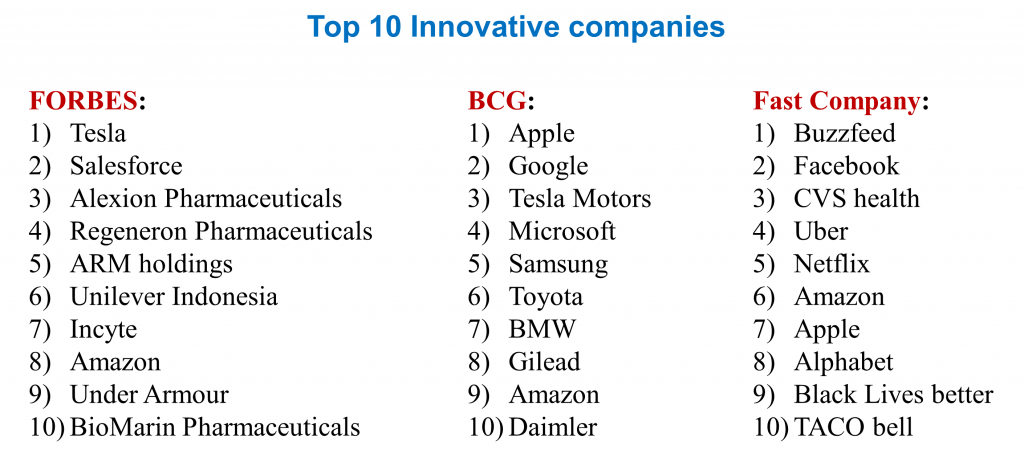

List of most-innovative companies:

I found three sources:

- Forbes ranks companies on innovation premium, which is the difference between their market capitalization and a net present value of cash flows from existing businesses. Market Capitalization is a straight forward number but the NPV of cash flows from existing business is based on a proprietary formula from Credit Suisse HOLT. The difference between the two (Market Cap and NPV) is the premium assigned by equity investors that indicates their hope on the ability of the company to come up with profitable new growth.

- BCG fields an annual innovation survey of thousands of senior level executives from a wide variety of countries and industries to make the list.

- Fast company asks companies to nominate themselves detailing their innovations. The final list of most innovative companies is prepared by the editors and reporters of Fast Company who evaluate the nominations.The top 10 companies in the three lists were:

It is quite natural for people to presume that the most innovative companies would also be the most profit making. To check the validity of this assumption, I searched for the list of most profitable companies and compared it with the above three lists.

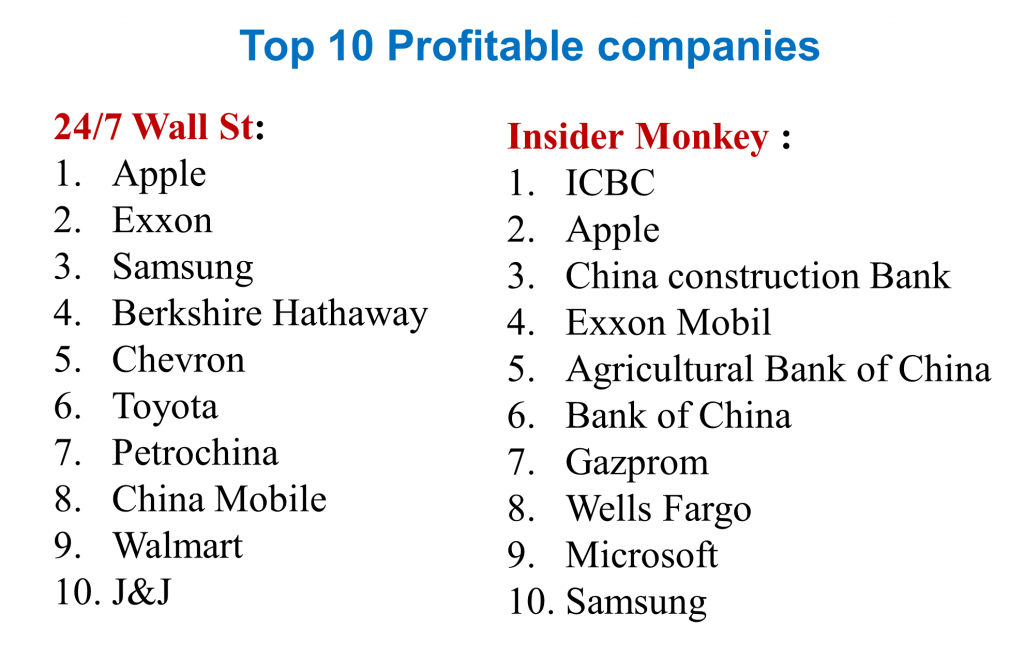

List of most profit-making companies:

I could find the following two sources:

- 24/7 Wall Street uses the net income from continuing operations to draw this list. While net income is the standard measure of profit, it includes items that do not reflect profitability from core business such as extraordinary and discontinued items and sales of subsidiaries or major holdings. Based on net income from continuing operations, it prepares the world’s most profitable publicly traded companies. Top 10 companies are given below.

- Insider Monkey ranks companies based on the earnings reported by Fortune 500.

Connection between the two lists:

In the two lists of top ten profit making companies and top ten innovative companies, there were only two companies that appear in both the lists – Apple and Samsung.

Why do top ten profit making companies do not appear in the list of top 10 innovative companies? Is innovation not necessary or sufficient for making good profits? And if I were to stretch this a little too far – ‘To make good profits, you should not be innovative’

There could be many reasons for not having any connection between the two lists, but the one that I believe has most influence is the use of perception to decide most innovative companies. Forbes uses a formula that contains ‘Market Cap’, which has perception built into it in terms of future expectations. The other two methods of survey and evaluation by editors also appear to be perception based.

On the other hand, the list of most profit-making companies is very objective as it is based on the annual P/L statement.

How is perception built?

The perception is an outcome of recent innovations of the company and/or the recent announcements about future innovations. Contribution of various types of innovation in building a positive perception is given below:

- New product and new service innovations in the B2C space have the highest influence

- New product or new service innovations in the B2B space has lower influence

- Process innovations have a miniscule or no influence on the perception

The most well-known measure for reporting the outcomes of innovation is ‘Revenue from new products launched in last three years’. Have you ever heard of “Cost saved from the process innovations in last three years”? The answer is clearly ‘No’. Why?

While the former (Revenue from innovations of last three years) could be tracked and reported using an ERP system, there is no system that helps in tracking and reporting the cost saved from innovations of last three years! Can an ERP system help in reporting cost saved from innovations?

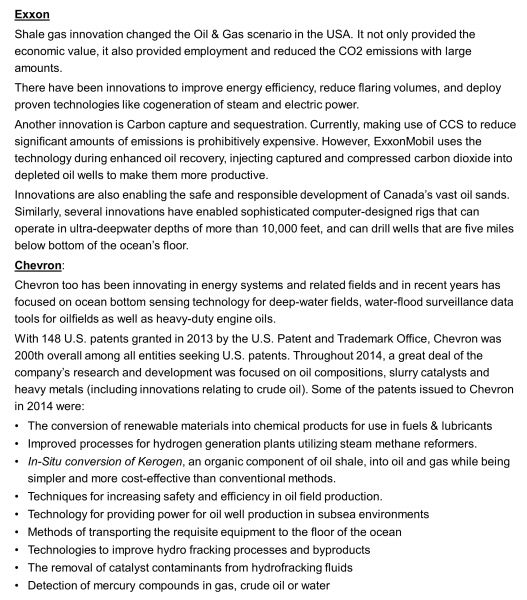

I searched for the innovations of two companies – Exxon and Chevron, which appear in the list of most profit-making companies (and I can show similar information from several other companies that I know). There is a considerable amount of information available on the web about these two companies and the summary of what I read is given below:

Solution lies with the ERP companies:

If we wish to break this dichotomy in the two lists (Most profit making and most innovative) we might have to take several steps. One of them would be to give equal importance to process innovations that save or reduce cost. I urge the ERP companies (eg SAP, Oracle) to provide a solution (which is not difficult, and I am willing to be part of this experiment) that would give process innovations their due recognition and would also enable them to make fair contribution in deciding the most innovative companies.

References:

- http://www.innovationexcellence.com/blog/2012/12/11/what-is-the-missing-cost-of-not-innovating/

- http://www.forbes.com/innovative-companies/list/

- https://www.bcgperspectives.com/most-innovative-companies-2015/

- http://247wallst.com/special-report/2015/10/27/the-most-profitable-companies-in-the-world/2/

- http://www.insidermonkey.com/blog/11-most-profitable-companies-in-the-world-in-2015-370043/

- http://fortune.com/2015/06/11/fortune-500-most-profitable-companies/

- http://www.forbes.com/sites/innovatorsdna/2015/08/19/how-we-rank-the-worlds-most-innovative-companies-2015/#658c47bf4524

- http://www.fastcompany.com/most-innovative-companies

- http://www.ipwatchdog.com/2015/02/13/chevron-energy-innovations-hydrofracking-to-biomass/id=54597/