In the recent years, there has been a lot of debate about companies being over-focused on short-term results to meet the expectations of stock-market (investors). People who support this view believe that this intense focus by companies on short-term is the key reason for companies to miss out on innovative opportunities that get picked up by the startup founders. I too agree and this post attempts to explain the problem and proposes a solution too.

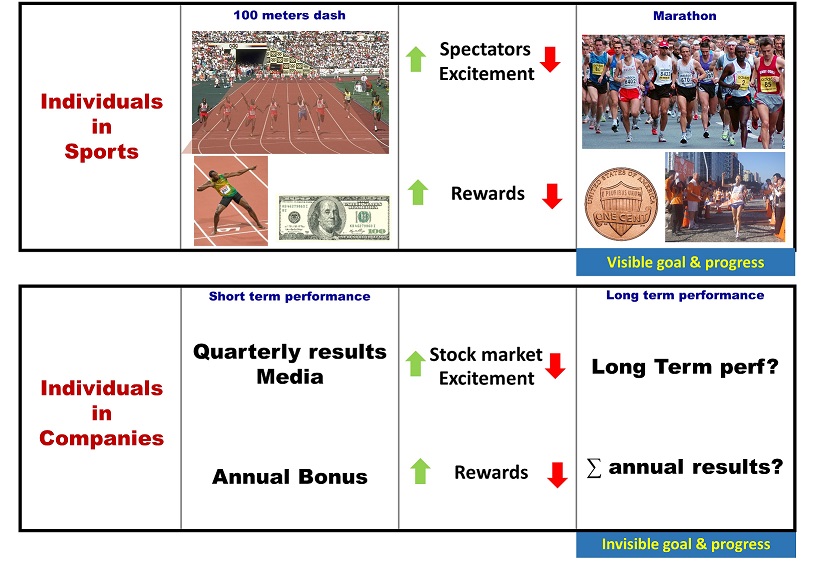

Stock markets reward companies (share price) based on the quarterly/annual performance and their perception about future projections and expectations. Companies, in turn, starting from their boards, reward their management based on annual performance. Stock markets neither have patience nor are they forgiving for unfavorable results; they penalize companies immediately if they fail to meet the expectations in one quarter.

Companies too penalize their managers for poor performance. The speed, type and quantum of this penalty depends upon many factors- the extent of shortfall in achieving the projected numbers leading to sentiments of investors and stock market. The penalty also depends upon the level/tenure/experience of managers. Compensation is the single largest lever used by companies for penalties not because employees are concerned of the financial loss but due to its influence on social status and future promotions.

Companies set the expectations of the stock-market by providing their outlook for future and performance projection for the next quarter/year. They also give a broad outlook of future. The projection in revenue and profit earnings for the quarter is targeted to achieve annual plan and the annual projection typically shows a linear/incremental growth over the past year. Such incremental projections are typically acceptable by the investors, who care more for certainty in achieving the projections. Other than the quarterly and annual performance, the sentiments of stock-market also depends on the company’s performance as compared to the competition.

As a result, companies fight tooth and nail to achieve the projected numbers. Most of the management time is spent in reviewing and taking decisions that would help achieve the results for the current quarter or the current year. New employees quickly learn that failure to achieve annual target would result in their getting chiseled in the next performance appraisal. of Depending upon how easy or difficult the situation is in the current quarter, management spends time in reviewing and taking decisions to meet the long-term investment plans committed to the board and investors. Many of these long-term investment plans (eg putting up a new factory, acquisitions) help in meeting the long-term expectations of the investors.

One common attribute for almost all these decisions is that they have less uncertainty about the outcomes (not necessarily the returns). Unfortunately, most innovations have uncertainty of outcomes also. Projecting a non-linear future performance based on innovations is considered imprudent by the managers and board.

This intense focus of companies in achieving the predicted quarterly performance that is better than the competition is the key reason that blinds the management from fledgling disruptive innovations and makes them slow to react when such innovations enter the market. In the last few years, many of these disruptive innovations have come from startups. Distributed intellectual power along with easier availability of capital has accelerated the start-up activity globally in development of technologies and business models.

Many incumbent large companies get a beating from the stock-market when startups outperform them. This forces such companies to invest a much larger capital in acquiring those startups. The research shows that the life of Fortune 100 companies is gradually diminishing. As compared to 2010, the number of interventions by activist shareholders seeking board representation, share buybacks & CEO removal has increased by 88%.

Some boards have stared compensating executives for Long Term value creation, but this is also based on the aggregation of results over multiple years. It has resulted in limited effect in solving our problem.

How do we get the board to qualitatively create and review long-term plans that would include innovation opportunities also? Some companies have done this successfully in the past – mainly because of a bold, innovative and charismatic CEO. We need a process that will make it happen consistently regardless of the personal charisma of the CEO/Chairman.

One could argue that shareholders have a myopic view but why? Do they have low confidence on the ability of the company to make long-term investments including in innovations? I believe that the intention of quarterly results was not to control, pressurize, or scrutinize the management but to create an opportunity to have frequent dialogues and build confidence.

Who is at fault? Is it the stock market which evaluates the company every quarter and decides to reward or penalize? Or is it the board and management who has created mechanism to immediately transfer these rewards and penalties of stock market to operating managers? I think it is both. (i) Someone or something must work as a shock absorber – like we have in automotive and (ii) we need to think if there is a way to reduce the frequent shocks. The idea of redesigning compensation is to make it absorb frequent shocks of the stock markets and enable managers to focus on long-term. It would drive them to think about innovation opportunities of future, make choices and keep invested in them for a longer duration.

To operationalize such a compensation, we will need a method to measure management on three aspects: (a) Ability to think about future innovations (b) Ability to make choices for investment (c) Ability to actually invest in them and persist with them over a period (unlike new year resolutions). The only way we could measure the above is to keep record of the outcomes on all three aspects and start the assessment once we have data of at least two years. The extent to which the compensation would have this component would depend upon the robustness of this process and the amount of shock that the board would like to absorb.

The above suggestion is somewhat similar to a treasure hunt game of a very long duration of several days or weeks. The game has to be played alongside another sport that the teams are already committed to (day-job)! The challenge therefore is to motivate the teams to find time, not once but for several days. This is likely to happen if the stakes for the teams are comparable to the stakes that the team already has in the sport that they are committed to (day-job). Unlike the treasure hunt where various teams compete to win the reward fixed by the organizers, the treasure in the innovation sport is decided by the investors (managers) themselves, which is nothing but the second part of the measurement.

There is one more difference – In Treasure-hunt or sports-bet the investor/sponsor has no control/influence on the player(s), but in innovation sport the managers (they are investors) can stifle or galvanize the innovators (players). (Refer to my other post: Innovations are driven from the top)

Treasure hunt has an element of luck, but it is not like buying a lottery ticket or participating in a sports-bet. It is an intensely involved game as teams should be aware of the current situation, be creative, and know the strengths & moves of the competing teams.

In other words, I am suggesting that the reward (variable pay) for driving innovations in the current year should be decided in future years when the outcomes of innovations are known. This means that every year management teams would receive variable compensation in two parts (i) For achievements related to the current annual plan (ii) For driving innovations in the previous 2-3 years, which would have fructified in the current year.

To introduce the second component of compensation, every company needs to initiate a simple system that tracks four items, which I have explained in detail in my book ‘Making Innovations Happen’.

- Inventory of innovations that are likely to happen in future

- The choices made by the company with details of investment needed for selected innovations. I refer this a share-of-future-innovations.

- The actual investments made every year on the selected innovations

- The final outcome in terms of impact created by the innovation as compared to the impact created by the innovations of competition.

The last question one could ask is – ‘Why should board introduce such a system?”

The core aspect of the fiduciary duty of directors in the board is ‘Loyalty’ and ‘Prudence’. To help directors successfully accomplish their role and help the company thrive for several years instead of becoming a source for quarterly pressure, the above change in compensation structure would be useful. It would be best for management and board to also discuss major innovations (similar to what the founders of startup would do in early stage).

Prof Jeff Dyer has introduced the concept of two types of mindset: Delivery and Discovery. The expectations of stock market and promises made by the companies to grow linearly supports the advancement of people with Delivery mindset and hence one could find that many senior management team in most companies is Delivery driven. Discovery mindset is considered critical for start-ups, but I feel that it is even more critical for established companies to guard against the threats of disruptive innovations. I am sure board members and executives with discovery mindset will be more amenable to experiment with this concept of introducing a change in the compensation to drive innovations using long-term plan.

I will leave with one question at the end – We discussed that established companies are focusing more on short term because of the pressure of investors and this is causing them to miss the opportunities of longer term. The opportunities missed by them, are become the reason for someone to start a new company. The consumers are getting innovations, if not from established companies the from startups. Where is the problem?

- http://www.aei.org/publication/fortune-500-firms-in-1955-vs-2014-89-are-gone-and-were-all-better-off-because-of-that-dynamic-creative-destruction/

- http://www.investopedia.com/terms/g/guidance.asp

- http://www.businessweek.com/chapter/degeus.htm

- http://www.wsj.com/articles/SB10001424052970203391104577124243623258110

- https://www.grantthornton.com/staticfiles/GTCom/Grant%20Thornton%20Thinking/Surveys/Performance_Based_LTI_Plans_Reprint.pdf

- https://hbr.org/2015/01/where-boards-fall-short

- https://hbr.org/2014/01/focusing-capital-on-the-long-term

- http://www.fclt.org/content/dam/fclt/en/ourthinking/%27FCLT_A%20Roadmap%20for%20FCLT%27.pdf

- Jeff Dyer, Hal Gregerson, and Clayton Christensen, The Innovator’s DNA: Mastering the Five Skills of Disruptive Innovators (Boston: Harvard Business Review Press, 2011)