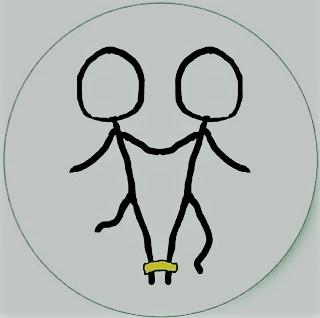

Most established companies see startups as competition. It is a natural instinctive reaction for them. Some companies who ask their managers to work with startups find their managers running a three-legged race that too with two people who are quite opposite in many ways, making the partnership difficult. Let’s list down the attributes of established companies and startups that make them appear opposite and then explore if there it makes sense to try and make it Yin-Yang relationship. (Seemingly opposite or contrary forces that may be complementary, interconnected, and interdependent in the natural world, and how they may give rise to each other as they interrelate to one another)

|

Startups |

Established Companies |

| · Likely to have deeper insights about local customers and markets. They are expected to be better aware about the pain points of customers and changing customer needs

· They have a new and better technology and do not have the burden of legacy systems · They are far more agile in their response. They are hungry and comprise a passionate set of people. · Their success is built on several smaller failures · They are more direct in their communication |

· Try to apply a generic brush to the global problems without consider local flavors.

· They have loyal set of customers · They have a well-established supply chain to reach out to customers · Well-known brand and cash surplus · Standard processes & improvement culture. · Thick lining of fat that keeps them somewhat insulated from the changes in the external world (but also from the changing technologies and customer needs). · Failures are generally not accepted in the measurement system of established companies – Cost of failure is considered to be too high · Managers are trained to be subtle and not offend others with their communication. |

Acquisitions: Established companies in traditional businesses like oil, chemicals, financial services (Banking, Insurance) Retail (Pharmaceuticals, Home furnishing, Groceries etc), Media, Automotive and Telecommunication have almost always acquired companies that are direct competitors (or could directly add to their revenue numbers). Established technology companies like CISCO, Google, Apple etc know the value of emerging technologies and have been acquiring tech startups, which may not necessarily result in direct revenues but may contribute in the development of their future technologies.

Opportunities: The best way to start for established companies in traditional business is to involve startups in solving the problems related to their internal operational processes. In the next step they could involve them in solving the problems at the interface with their customers (Channel partners) and suppliers (logistics company) and finally in solving the problems of customers and suppliers that may directly help them in their financial numbers or in developing better relationship and royalty.

The most difficult partnership is ‘Joint go to market’. This needs a lot of trust and could happen only if the offerings of two partners are not only clearly and unambiguously complementary but are also IP protected to a large extent.

Roadblocks: Having worked with large management & IT consultants, established companies perceive startups also as one of those. On the other hand, the procurement officers who are not trained in valuing IP, treat startups as another commodity suppliers. They fail to understand that payment terms matter a lot to startups and established companies need to understand and be flexible. As far as I know, startups do not want companies to beat around the bush and take a lot of time. They want to be told straight and quick if there is an interest (remember they are thinly staffed and cannot afford customer relationship manager).

We need a bridge between the two and I believe the established companies should make this investment as they have a better chance of getting disproportionately higher short-term gains but if not engaged might have a substantial opportunity loss.

Removing the above roadblocks and making a bridge would be similar to the ‘The Maverick’ technique, which was invented by Mark Howlett and Rab Lee for three-legged race where one person leans slightly in front of the other to enable faster running!